December 18, 2018

The conference room walls at Tortillas Inc. are full of framed newspaper stories, local ball team pictures and awards for a business that feels like family. Not long after we arrived, a homemade lunch showed up for the entire office as it does many days, courtesy of President and CEO Gustavo “Gus” Gutierrez’s mother, Felicitas.

With plates piled high with ribs and black chili, rice and beans – and freshly made corn tortillas and chips – we heard from Gus, his sister and Tortillas Administrator Teresa Martinez-Gutierrez, and Alex Nin, GM, about the company’s growth, and its highs and lows along the way.

We talked with employees like Yurelis, who had worked her way up from packing tortilla chips, to filing and answering phones, to food safety and training coordinator. She’s jokingly known around the office as “mil usos” – a thousand uses.

Yurelis started part-time at Tortillas while in high school. Now, after five years, she’s gained increasingly more responsibility, received multiple promotions and has seen a steady advance in pay. In 2017, she was named “Employee of the Year.”

Yurelis’ father and sister both work at the company as well. But even if they didn’t, she says, it would still be like family. She says you feel it when you first come into the company’s doors: everyone is happy.

The optimism and hard work that first drove Gus’ and Teresa’s father, Jose Luis, and his dream of founding Nevada’s first tortilla factory back in 1979 certainly seems to be in full force today.

From shoestring to solid growth

The first years were a struggle for the company, and a fire in 1985 all but shut it down. With the help of industry friends and extended family, the family persisted, landing the first of many major accounts.

Today, Tortillas has grown into a multi-million-dollar business. Flexible and patient capital – in connection with the New Markets Tax Credit (NMTC) program, a federal tool that aims to increase the flow of capital into distressed communities, like parts of North Las Vegas – enabled Tortillas to purchase new packaging and kitchen equipment and refinance existing loans.

This additional financing helped put the company where it needed to be to get to the next level, Gus says. With its new kitchen facility, the company has entered another growth phase, expanding into multiple product lines by making salsas, beans, chili rellenos and other prepared foods, instead of simply distributing them.

Still, the business hasn’t been without challenges. With three separate facilities – a production plant, warehouse facility and kitchen, Gus says employees have become logistical experts, constantly moving things around to keep operations running as smoothly as possible. Walking across the street from the production facility to the warehouse, he explained that the company is at full capacity – yet customer demand continues to grow.

Tortillas is looking to build a new $5 million facility, consolidating the three buildings into one and increasing efficiency. The new facility will open even more opportunity for the company, which now ships across Nevada, Colorado, Utah, Arizona and California.

Community at its best

With many employees living within a mile or two of the current location and sharing rides to work, it was important to Gus and the management team that the new Tortillas facility remain in the North Las Vegas community it has long called home. They found space just three miles away, ensuring the opportunity for people to work where they live.

The company’s focus on family and flexibility is evident. Many employees have family outside of the country and Tortillas offers flexibility should they need to return home for a family issue – whether the time off is a week or a month.

Like Yurelis, Natalie, too, says the company is much like family. While on school vacations, her kids have joined her at the office, and the company sponsors her son’s color guard team and her daughter’s cheerleading squad.

An account executive for the past four years, Natalie had been a bartender at the Venetian on the Las Vegas Strip – just 20 minutes from Tortillas, but what seems like a world away – before coming to work at the company.

She stressed the opportunity to grow with the company and – in her role – make her own pay. She just bought her first house a year ago, all due to the financial security the company provides, she says.

Providing the tools and opportunity to advance

We also talked with Blanca, a single mom who started in the production area seven months ago, but quickly moved up into a customer service role.

Blanca woke early to get her kids up, dressed and to the babysitter before her production shift began at 5:00 am. The job was a good one, but the early morning routine took a toll. Blanca approached her supervisor to see if there might be another opportunity for her at the company, one that would provide more balance and time for her kids. She’s now working in the front office of the warehouse facility, in one of the company’s public-facing roles. Speaking both Spanish and English fluently, she’s a perfect fit for the job.

The company often hires and promotes from within, offering on-the-job training, job shadowing and company-wide training. Connie, who works in production, recently took classes to learn to drive a forklift. She’s also joined food safety training and many other sessions, helping her prepare for other roles within the organization.

When asked to share a few employee success stories, Gus and Teresa easily named off a half-dozen people. We learned about Francisco, who was hired to sweep floors and now manages the entire distribution operation. And Antonia, who began packing tortillas 15 years ago and currently leads food safety and control.

They told us about Luis, who began in the warehouse and was quickly promoted to management. And how Julio progressed from machine operator to lead production manager.

Their comments echo what we heard from employees: the company provides ample opportunity for growth. And once they arrive, they’re family.

Investing for impact

At Advantage, we look to invest in growing companies like Tortillas, companies that offer not only strong job creation but all the other elements that flow from a job: wealth creation opportunities, benefits, wage progression, training and workforce development.

These are the things that matter for people. And they’re the things that make a business a good one – helping to grow, revitalize and re-energize communities.

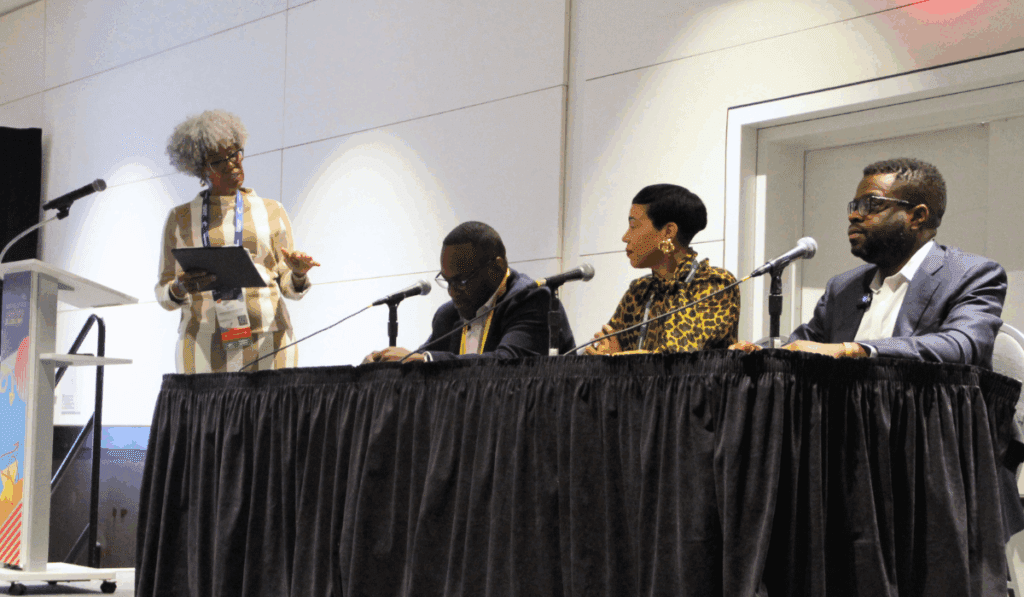

Photo caption: Juan Cervantes pauses in the warehouse at Tortillas Inc., a family-owned business in North Las Vegas, NV

The investments, portfolio companies and recommendations listed on this website represent only a sample of companies that have received investment capital from Advantage Capital-related entities. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities highlighted herein or contained in any other information provided by Advantage Capital. Past performance is no guarantee of future results. For a full list of companies, please click here.