May 27, 2021

It’s been almost seven months to the day that Stirling Ultracold first publicly announced its role in global COVID-19 vaccine storage and distribution efforts. As the only company to produce freezers capable of storing any COVID-19 vaccine requiring ultra-low temperatures, Stirling played a key role in public health efforts. Since then, it’s been at the forefront of a global priority. It also just recently closed a public merger with BioLife.

Five years ago however, things looked slightly different at Stirling Ultracold (then Global Cooling). Advantage Capital’s first investment in the company in 2016 helped expand manufacturing capacity for its unique Stirling engine, an efficient alternative for compressor-based engines found in standard ultra-low temperature freezers. In late 2018, Advantage Capital supported another capital raise with a $4 million investment in connection with the Ohio Rural Business Growth program.

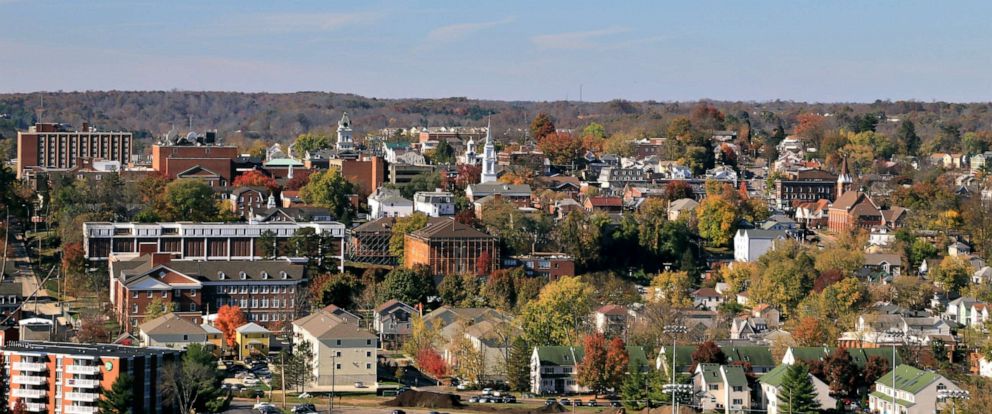

“With the Ohio Rural Business Growth program, our goal was to provide businesses like Stirling Ultracold better access to the capital they needed to expand and grow good quality jobs for Ohioans,” said Senator Bob Peterson. “I couldn’t be more proud of Stirling Ultracold and its workforce—with technology developed and manufactured right here in Athens, by real people making a real difference, the company’s job growth and continued expansion will bring lasting economic opportunity to the entire region and further build this community.”

As Stirling Ultracold’s largest institutional investor, Advantage Capital has invested nearly $8 million in the company, in part via the Ohio RBG program, supporting it through pivotal growth stages and spurring job creation. Stirling secured a third investment in early 2021 to support additional capacity in Ohio as global sales escalated for its ultra-low temperature freezers for COVID-19 vaccine storage.

“The flexible financing we received along the way provided the runway we needed to fund new product development, hire key staff and expand technology and manufacturing capacity,” said Phill Reynolds, chief financial officer at Stirling Ultracold. “Without that early support, our success may have been delayed.”

“Each investment has provided a distinct catalyst for Stirling’s growth: whether it was the first investment in the buildout of their world-class manufacturing facility in Athens, or the last investment to support a surge of vaccine-specific demand for their products. Our unique ability to invest up and down the balance sheet, with patient and flexible capital over multiple years, has helped to sustain and build what is a great business today,” said Chris Harris, principal with Advantage Capital.

The recent BioLife merger represents a major opportunity for Stirling Ultracold—bringing immediate benefits to its team with the expanded breath and scale of technologies BioLife Solutions offers. With BioLife’s commitment to keeping Stirling Ultracold and its 150+ jobs in Ohio, the merger also brings further economic opportunity.

While Stirling Ultracold has created dozens of new jobs since Advantage Capital’s initial investment –with its workforce expanding by 30% in just three months alone – job quality stands out. As part of its ongoing impact tracking and assessment for every investment it makes, Advantage Capital monitors and guides portfolio companies’ actual jobs-based impacts. At Stirling, wages average more than twice the local living wage, along with family strengthening benefits and job training.

“I am inspired every day by my colleagues and what Stirling Ultracold has been able to accomplish. I was initially attracted to Stirling because of their innovative technology, sustainability initiatives and support of the local workforce. I’ve come to realize that the people you collaborate with daily, and the corporate culture are just as important as what the company stands for. Our teams here are passionate, dedicated, knowledgeable and make work feel less like work,” said Jennifer Shrider, marketing specialist at Stirling Ultracold.

Chief Strategy Officer Neill Lane remarked, “What we have achieved together has been remarkable. I am proud of our people and our ability to make a positive impact on the community and the regional economy.”

The investments, portfolio companies and recommendations listed on this website represent only a sample of companies that have received investment capital from Advantage Capital-related entities. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities highlighted herein or contained in any other information provided by Advantage Capital. Past performance is no guarantee of future results. For a full list of companies, please click here.