October 30, 2023

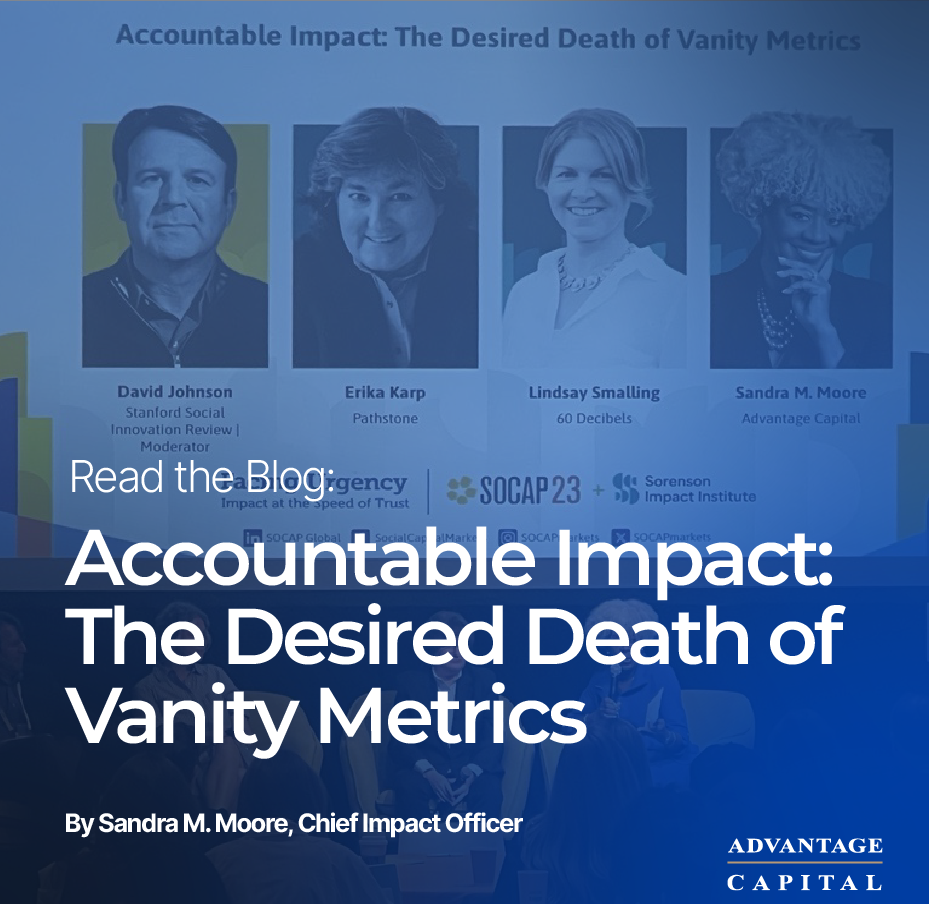

I recently joined industry experts including Davis Johnson, Erika Karp and Lindsay Smalling in a panel at the SOCAP 2023 conference to discuss an important topic: How we measure and define our work in impact investing. During our time together, we unpacked and discussed the need for strong metrics and framework surrounding our industry to ensure we drive the change we wish to achieve.

Simply put, too often investors looking to do good fall short when it comes to defining goals and measuring output. The number of investments, amount invested and even the number of jobs created is good to know, but what does that really tell us about the outcome of an investment made for impact? To keep impact investors accountable, we must set a robust framework and hold ourselves to strong standards and meaningful measurement. Only then can we truly know if we are meeting the mission of impact investing.

Impact investing as a form of finance is relatively new. However, Advantage Capital has been doing it for more than 30 years—developing key insights along the way to ensure the financing we provide to businesses and entrepreneurs is reaching our double bottom line of achieving impact while delivering returns to our investors.

The insights we have gleaned over three decades have enabled us to develop a rigorous framework supported by deliberate metrics and standards.

Developing an Investment Framework

Impact investing can mean a lot of things to a lot of people, which is why when developing an impact investment strategy, investors must lay out the framework for what they wish to achieve. For instance, environmental investors must be clear in their mission and the outcomes they want to see. Do they want to reduce carbon emissions? Do they want to provide people with affordable clean energy? And then they need to get granular in how they measure those impacts. By laying out a framework upfront, investors can set clear goals and work toward them to achieve the true spirit of impact investing with intentionality and rigor.

My panel participants noted that good investors have been using impact data for decades, knowingly or not. Accountability has always been key. Are the investments successful? Are the companies using the capital as intended … most often to enable growth?

At Advantage Capital, our true north is job creation. However, we go much deeper than just job creation. Our mission and overall framework are to bring businesses, jobs and technologies to communities that have historically lacked access to investment capital, while producing competitive returns for our investors. How do we know we are meeting this mission? We don’t just look at the businesses and jobs our financing support, but we look at the quality of the jobs and business model the entrepreneurs behind our investments create. We invest with intentionality in distressed communities to bring economic vitality to the people that live there.

The key to keeping ourselves accountable goes beyond just developing a framework. We define and measure key metrics and stick to strict standards.

Defining Metrics and Keeping up with Standards

Every single deal we do goes through a rigorous vetting process and is measured against a time-tested, carefully configured proprietary impact matrix. Before a deal can even be brought to our investment committee it must be vetted to ensure it reaches our threshold standard.

At SOCAP, we emphasized the need to focus on outcomes rather than so much high fiving over outputs. Yes, a lot of work needs to go into the pursuit of impact. Effort produces the outcomes. But how can we move from proving impact to improving impact?

We actively and intentionally seek out businesses in underserved communities that have historically lacked access to the type of flexible financing we are able to provide. That framework is foundational to how we assess impact before making any investment. Secondly, but just as important, we look to see if the entrepreneur and business is willing and able to provide the types of quality jobs that lead to household stability and drive economic vitality in local communities. So how do we know the businesses we invest in are truly driving impact?

Once we have made an investment, the business gets put into our biannual survey. Every six months we survey our portfolio companies on core metrics such as jobs creation and retention, whether they offer health benefits and retirement options, job accessibility, wages and more. These metrics are how we define and approach impact.

And year after year our companies continue to deliver on impact. In fact, our latest survey showed that:

• 94% of companies offer jobs accessible to those without a college degree.

• 98% of employees receive health benefits.

• 98% of employees have access to wealth creation programs such as a 401(k).

• 77% of employees have access to training.

• 15% of companies report that wages allowed new employees to replace one or more public assistance programs.

These metrics are central to ensure we are meeting our mission. We have a saying at Advantage Capital—If you can’t measure it, you didn’t do it. And that saying is in the ethos of what we do. These metrics are far from vanity metrics. They are intentional and deliberately measured to ensure we are doing the good work we set out to do.

We don’t just apply this kind of rigorous data mining to our small business investing line of business. We apply this same kind of meaningful, data-backed measurement to the way we invest in affordable housing as well as renewables. We have an obligation to apply our learnings and principles across all our investments. Community impact doesn’t start and stop with jobs, we need to look beyond vanity metrics in other areas as well.

Framework and measurement are how we move forward as an impact industry and impact investors must adopt these principles if they are to drive meaningful change through finance.

To learn more about Advantage Capital’s approach to impact and measurement read our annual impact report here.